Money’s daily mortgage rates are based on a variety of factors, including credit score, down payment size and whether the loan is conforming or jumbo.

But as interest rates rise, mortgage applicants like Katrina Wooten are turning to adjustable rate loans that start out with a lower interest rate. However, they come with the risk that their rate will reset later on.

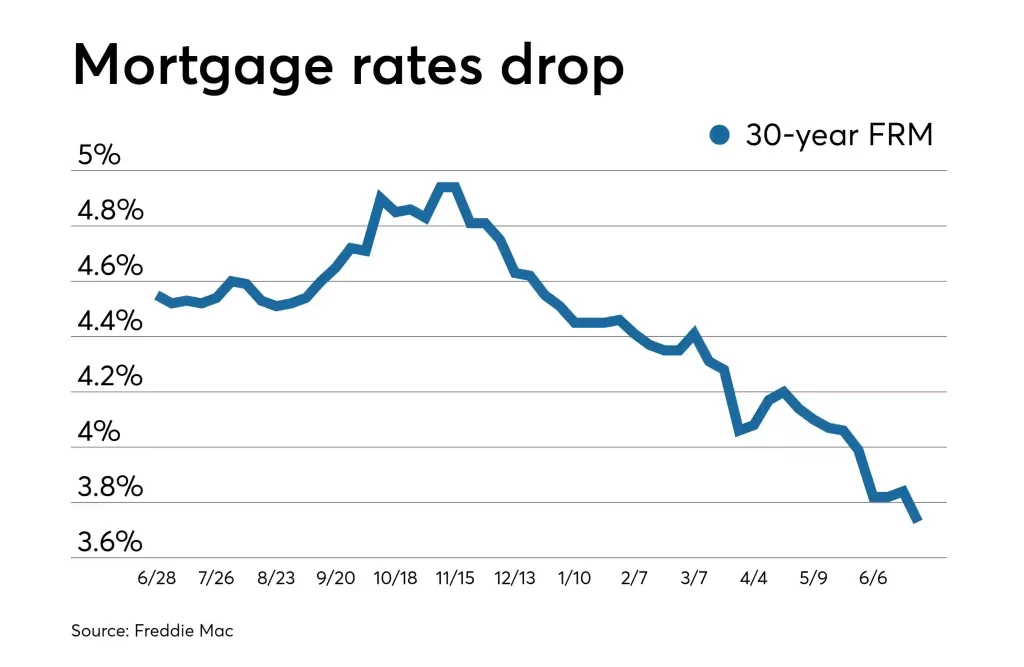

Rates Move Lower

Just a couple weeks ago, mortgage rates were on the verge of surging above 7% for the first time in months. But on Thursday, those rates were actually lower, making it a bit easier for homebuyers to afford the price of a new home.

Freddie Mac’s weekly rate survey showed that mortgage rates this week are averaging 6.27% for a 30-year fixed-rate loan and 5.76% for a 15-year fix. However, your actual mortgage rate will depend on your credit score, down payment, and the lender you choose.

Mortgage rates are highly volatile, and it’s difficult to attribute changes in any one week to a single factor. However, the current macroeconomic environment has a lot to do with it.

A steady flow of weak economic data has been keeping investors cautious, and the Federal Reserve’s policies have also weighed on rates. The Fed buys bonds to reduce inflation and stimulate the economy, and its bond-buying program was a major factor in low mortgage rates throughout much of 2021. But the Fed’s policy changed last November, when it started slowing its bond-buying program and reducing the size of its monthly purchases.

The resulting higher interest rates have made many homeowners and homebuyers reluctant to lock in too early, but for Katrina Wooten, a prospective buyer near Gainesville, Florida, that meant holding off on locking in a rate. Wooten’s mortgage broker has suggested that she consider an adjustable-rate mortgage, which starts out lower than a fixed-rate loan. But Wooten says she’s worried that the monthly payments will eventually rise beyond her budget’s comfort level.

Despite the volatility, mortgage applications to purchase homes have been climbing in recent weeks. Last week, they rose 4% compared with the previous week, according to the Mortgage Bankers Association. However, they are still down 28% compared with the same week last year when rates were much lower. The MBA expects that a more stable housing market and lower rates will boost applications further. And that could help keep mortgage rates at the more affordable levels seen in past years. Until then, it’s best to take your time and shop around for the lowest possible rates.

Freddie Mac’s Weekly Rate Analysis

Mortgage rates remained low this week, which is good news for home buyers looking to take advantage of the spring buying season. According to mortgage buyer Freddie Mac, the average rate on a 30-year fixed-rate loan dropped to 6.43% this week. In the previous week, the average was 6.54%.

The drop in rates was a welcome relief for many prospective homeowners, who had been struggling with rising borrowing costs. And it was especially welcome as the housing market continues to struggle amid a lackluster job market and stubbornly low inventory of homes for sale.

However, borrowers should keep in mind that even though rates moved lower this week, it’s important to compare quotes from different lenders to find the best deal. Interest rates change daily, and it’s important to keep a close eye on them in order to ensure that you’re getting the most competitive rate.

Freddie Mac conducts weekly surveys of lenders on their interest rates and points for first-lien prime conventional conforming mortgages with a loan-to-value ratio of 80 percent or less. The survey covers a sampling of lenders nationwide and includes a mix of lenders, including thrifts, credit unions, commercial banks and mortgage lending companies.

Mortgage interest rates can move up and down for a number of reasons, but the most common is that the Federal Reserve raises or lowers its benchmark federal funds rate to encourage or deter borrowing and spending. In addition, the health of the economy and inflation rates can also influence interest rates.

The biggest difference between fixed-rate and adjustable-rate mortgages is that with a fixed-rate mortgage, the interest rate stays the same for the life of the loan. In contrast, an ARM starts out with a low interest rate for an initial period that can be as long as three, five, seven or 10 years. After the initial period, the rate changes to reflect current market conditions by adding an index interest rate and a margin, a number set by the lender.

When considering whether to choose a fixed or variable mortgage, it’s important to consider how flexible your budget is and if you can afford an increase in your monthly payments if interest rates rise. Additionally, it’s essential to read your mortgage documents carefully to make sure that you understand the consequences if you refinance your mortgage or sell your home before it is paid off. For example, some lenders charge a prepayment penalty if you pay off your mortgage before the end of your term.

ARMs Are More Popular

ARMs are more popular than fixed-rate mortgages at the moment, especially for home buyers who want to purchase a starter home and plan to move or refinance within a few years. This is largely because ARMs come with lower initial interest rates than fixed-rate mortgages. However, borrowers need to consider their budget and their appetite for financial risk before choosing an ARM. After the initial rate period, the ARM’s monthly payment could rise significantly if market interest rates are higher than when the loan initially started.

According to Freddie Mac, a large majority of ARM borrowers say the most important factor in deciding on their mortgage is affordability. That’s understandable since the initial below-market ARM loan payments can allow buyers to afford homes that may otherwise be unaffordable with a fixed-rate mortgage. But if the borrower believes interest rates will be lower when their mortgage’s rate adjusts, they may end up with an unaffordable monthly payment and could lose their home to foreclosure.

To prevent this, many ARMs have caps that limit how much the interest rate can increase in a single period and over the life of the loan after the initial fixed-rate period ends. But this is still a risky option for hourly earners who are on the cusp of needing to move or refinance because the higher mortgage rates could force them out of their home.

The ARM’s low initial rate can also make it easier for a borrower to qualify for a larger loan, which can be helpful for people who have less saved for a down payment and need to buy a bigger home. Also, a low initial interest rate can mean the borrower doesn’t need to purchase PMI, which saves money each month.

Most ARMs have an initial fixed-rate period that lasts for three years (a 3/1 ARM), seven years (a 7/1 ARM) or 10 years (a 10/1 ARM). Once this fixed-rate period ends, the mortgage’s interest rate will change annually based on an index and an agreed-upon margin. The number of times the interest rate can change each year is spelled out in the loan document, which borrowers should carefully read to make sure they understand when the rate will change and how often.

Buying a Home

Whether you’re thinking about buying your first home or are ready to trade in the rent-and-chips lifestyle for your own place, homeownership comes with many benefits. One major benefit is a predictable monthly payment that builds equity over time, and a 30-year fixed-rate mortgage can help you do that.

For many borrowers, choosing the right mortgage loan depends on a number of factors. The interest rate on a mortgage is usually the most important, because it determines how much you pay each month and over the lifetime of your loan. But other factors, like your budget and appetite for financial risk, also come into play.

If you’re shopping around for mortgage rates, it’s important to understand the difference between a fixed and adjustable rate mortgage. Adjustable-rate mortgages, or ARMs, offer lower initial interest rates than traditional fixed-rate mortgages, but they may have higher monthly payments later on. ARMs typically have a fixed interest rate for the first five, seven or 10 years of your loan, then they start to adjust at regular intervals (typically every six months or every year) depending on what’s happening with mortgage rates in the market.

Each adjustment brings the potential to increase your mortgage payment or total loan cost, and each one is a little bit more volatile than the last. This makes ARMs better for people who plan to move or refinance within a few years and want to save on upfront costs, but who aren’t comfortable with the risks that come with a longer-term fixed-rate loan.

The other major downside to ARMs is that if you sell or refinance before your term ends, you may be hit with a prepayment penalty. Depending on the lender and mortgage loan terms, this can mean you’ll pay thousands in extra interest charges.

Ultimately, Wooten plans to go with a traditional fixed-rate mortgage. She thinks it’s worth the higher monthly payments to avoid the risk of an unexpected mortgage-rate rise down the road. She also hopes that by sticking with her budget, she can pay off her mortgage in half the usual time and save a lot of money over the years.

Conclusion

When choosing a mortgage, one of the most significant decisions you’ll make is whether to go with a fixed or adjustable mortgage rate. Here’s what you need to know about fixed vs. adjustable mortgage rates this week:

Fixed mortgage rates:

A fixed-rate mortgage has an interest rate that stays the same for the life of the loan, regardless of market conditions. This means that your monthly payment will remain the same, providing stability and predictability for your budget.

Adjustable mortgage rates:

An adjustable-rate mortgage (ARM) has an interest rate that can fluctuate based on market conditions. This means that your monthly payment can vary, making it more difficult to budget for your mortgage payment.

Here are some FAQs related to fixed vs. adjustable mortgage rates:

- Which is better: a fixed or adjustable mortgage rate?

It depends on your financial situation and risk tolerance. A fixed-rate mortgage is generally a safer choice if you prefer stability and predictability, while an adjustable-rate mortgage can be a good choice if you are comfortable with some level of risk and want to take advantage of lower rates in the short term.

- What is the initial interest rate for an adjustable mortgage?

The initial interest rate for an adjustable mortgage is typically lower than the rate for a fixed-rate mortgage. This lower rate can make the initial payments more affordable, but it’s important to consider that the rate can increase over time.

- How often can an adjustable mortgage rate change?

The frequency of rate changes depends on the terms of your mortgage agreement. Typically, the rate can change annually, but it can also change more frequently.

In summary, when choosing between fixed vs. adjustable mortgage rates this week, it’s important to consider your financial situation and risk tolerance. A fixed-rate mortgage offers stability and predictability, while an adjustable-rate mortgage can provide lower initial payments but carries more risk over the long term. Be sure to read the terms of your mortgage agreement carefully and compare rates from multiple lenders to find the best deal.